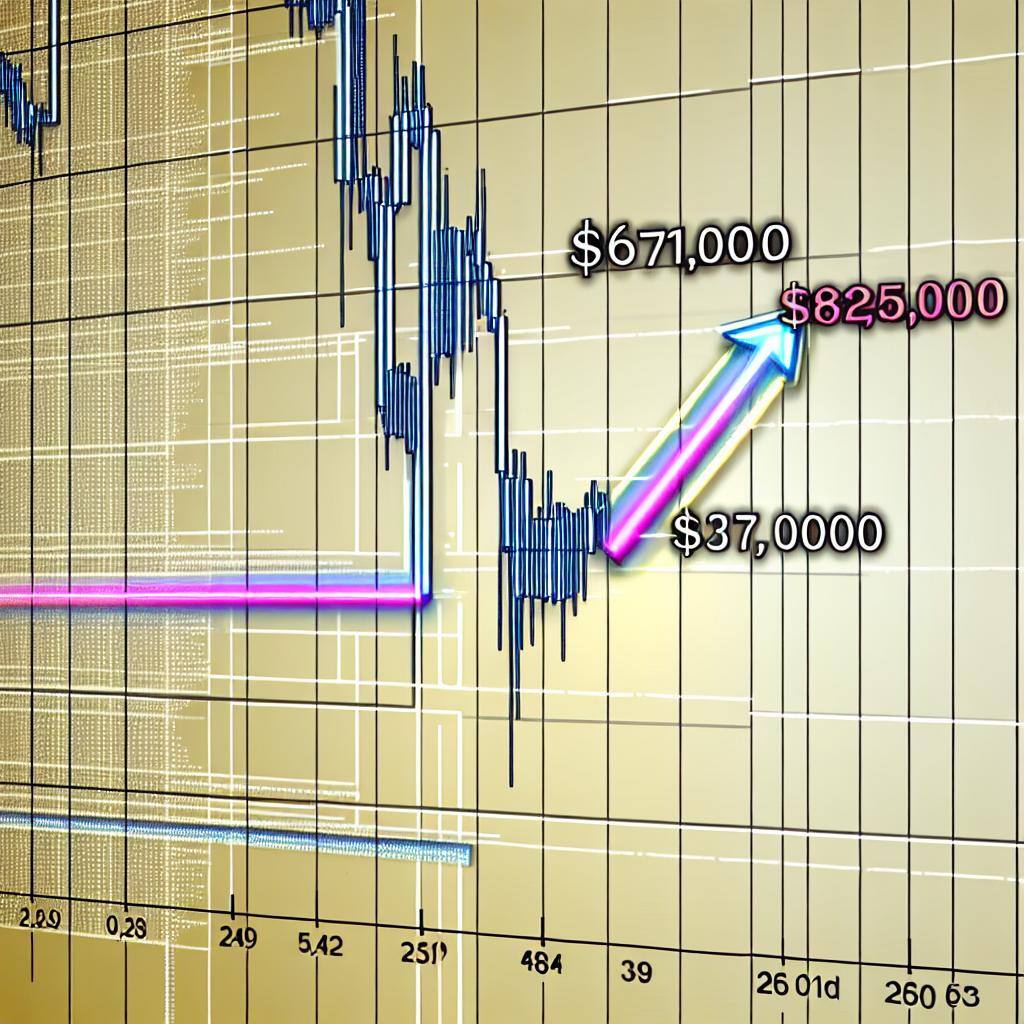

As of today, Bitcoin (BTC) has experienced a notable fluctuation in its value. After a drop to nearly $65,000, it has shown resilience with a rebound to approximately $67,000. This volatility is not uncommon in the cryptocurrency market and often leads to a ripple effect across various altcoins.

Bitcoin’s Current Situation: The recent movements in Bitcoin’s price have been attributed to various factors, including policy decisions by the Federal Reserve and developments in the futures markets. Despite these challenges, Bitcoin has managed to maintain its dominance in the market, with a current price of $67,114.19 USD and a 24-hour trading volume surpassing $32 billion USD.

Impact on Small Alternative Cryptocurrencies: Bitcoin’s price dynamics often set the tone for the rest of the cryptocurrency market. While there is evidence of long-term correlation between Bitcoin and altcoins, specific events can lead to divergent effects. For instance, when Bitcoin surges, investors may seek higher returns from lesser-known coins, leading to increased interest and investment in these alternatives.

Outlook Based on Fundamentals: Looking ahead, the fundamentals of Bitcoin remain strong. Its decentralized nature, capped supply, and increasing adoption by both retail and institutional investors solidify its position as a digital store of value. The ongoing development of the Lightning Network and other technological advancements are likely to enhance its utility as a medium of exchange.

For small alternative cryptocurrencies, the outlook is promising yet nuanced. The success of these altcoins hinges on their ability to offer differentiated use cases, technological innovation, and community support. Projects that address specific market needs and demonstrate robust development activity may see increased adoption and resilience against market volatility.

Risks Ahead: However, investors should be aware of several risks ahead:

- Regulatory Uncertainty: Governments around the world are still grappling with how to regulate cryptocurrencies. Sudden changes in regulations can lead to significant market disruptions.

- Market Manipulation: The cryptocurrency market is still relatively young and can be susceptible to manipulation by large holders or ‘whales’.

- Technological Flaws: As innovative as these technologies are, they’re not immune to bugs or security vulnerabilities which can be exploited.

- Competition: The influx of new cryptocurrencies creates a highly competitive environment where only a few may succeed in the long term.

- Market Sentiment: Cryptocurrencies can be heavily influenced by public sentiment which can be unpredictable and lead to rapid price changes.

Conclusion: The cryptocurrency market is interconnected, with Bitcoin often acting as the barometer for broader market sentiment. Its current stability amidst volatility suggests a cautious optimism that could bode well for small alternative cryptocurrencies. As investors continue to navigate this ever-evolving landscape, staying informed and agile remains key to capitalizing on potential opportunities while being mindful of the risks involved.